Top 7 Highest APY Crypto Staking Platforms!

Earn Passive Income with High APY Staking: Unveiling the Best Platforms of the Year

By reading the article “Highest APY Crypto Staking Platforms” published in Adaas Investment Magazine, you will be fully familiar with the best crypto staking platforms offering the highest APY in 2023 and learn how to earn passive income while securing blockchain networks! This level of familiarity can be enough when you need educational information about this topic.

Staking is a key part of many Proof-of-Stake (PoS) blockchain networks. In a PoS network, validators are chosen to verify transactions and add new blocks to the blockchain based on the amount of cryptocurrency they have staked. Stakers are rewarded with new coins or tokens for their participation in the network.

This article will explore the top crypto staking platforms offering the highest APY in 2023. We will also discuss the factors that affect staking APY, as well as tips for successful crypto staking.

Table of Contents

Top Highest APY Crypto Staking Platforms (2023)

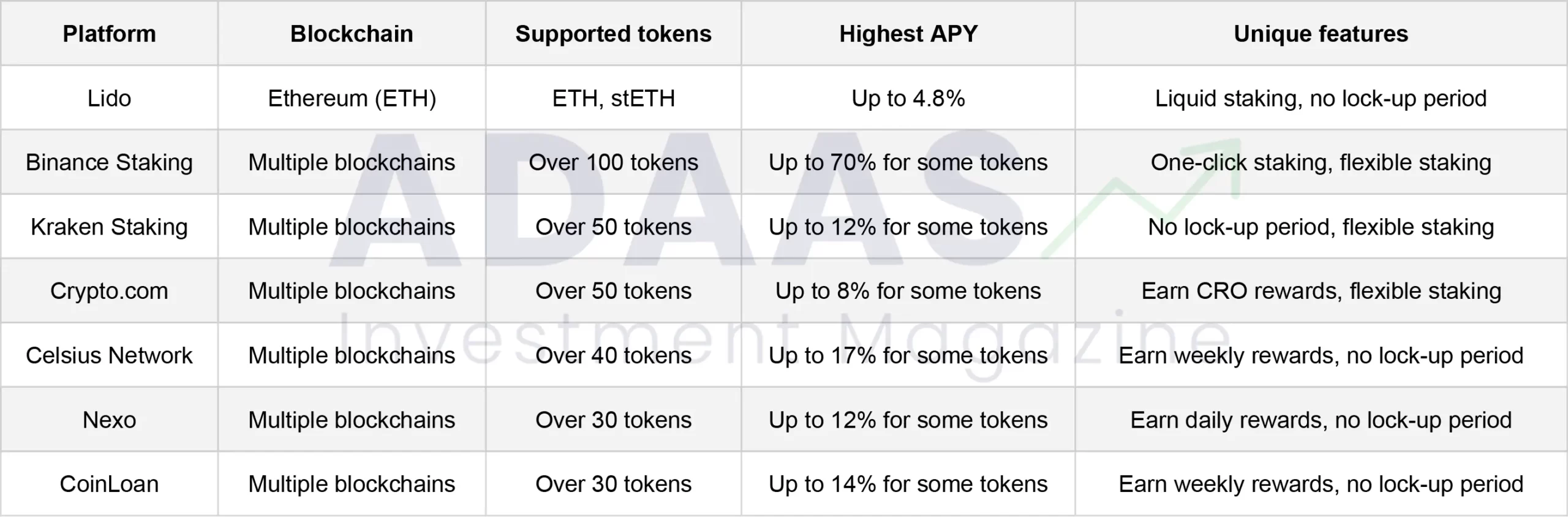

Here are the top 7 highest APY crypto staking platforms in 2023:

Lido:

– Name: Lido

– Blockchain: Ethereum (ETH)

– Supported tokens: ETH, stETH

– Highest APY: Up to 4.8% for ETH staking

– Unique features: Liquid staking, no lock-up period

Lido is a liquid staking platform that allows users to stake their ETH without having to lock it up. This means that users can still trade or sell their ETH while it is staked, and they can unstake it at any time. Lido currently offers an APY of up to 4.8% for ETH staking.

Binance Staking

– Name: Binance Staking

– Blockchain: Multiple blockchains

– Supported tokens: Over 100 tokens

– Highest APY: Up to 70% for some tokens

– Unique features: One-click staking, flexible staking

Binance Staking is a popular staking platform that offers a wide variety of supported tokens. Binance currently offers an APY of up to 70% for some tokens. Binance Staking also offers one-click staking, which makes it easy to start staking your cryptocurrency.

Kraken Staking

– Name: Kraken Staking

– Blockchain: Multiple blockchains

– Supported tokens: Over 50 tokens

– Highest APY: Up to 12% for some tokens

– Unique features: No lock-up period, flexible staking

Kraken Staking is a secure and reliable staking platform that offers a variety of supported tokens. Kraken currently offers an APY of up to 12% for some tokens. Kraken Staking also offers no lock-up period and flexible staking, which gives users more flexibility.

Crypto.com

– Name: Crypto.com

– Blockchain: Multiple blockchains

– Supported tokens: Over 50 tokens

– Highest APY: Up to 8% for some tokens

– Unique features: Earn CRO rewards, flexible staking

Crypto.com is a popular cryptocurrency exchange that also offers a staking platform. Crypto.com currently offers an APY of up to 8% for some tokens. Crypto.com also offers CRO rewards for staking, which can increase your returns.

Celsius Network

– Name: Celsius Network

– Blockchain: Multiple blockchains

– Supported tokens: Over 40 tokens

– Highest APY: Up to 17% for some tokens

– Unique features: Earn weekly rewards, no lock-up period

Celsius Network is a crypto lending platform that also offers a staking platform. Celsius currently offers an APY of up to 17% for some tokens. Celsius also pays out rewards weekly, which can help you earn more interest.

Nexo

– Name: Nexo

– Blockchain: Multiple blockchains

– Supported tokens: Over 30 tokens

– Highest APY: Up to 12% for some tokens

– Unique features: Earn daily rewards, no lock-up period

Nexo is a crypto lending platform that also offers a staking platform. Nexo currently offers an APY of up to 12% for some tokens. Nexo also pays out rewards daily, which can help you earn more interest.

CoinLoan

– Name: CoinLoan

– Blockchain: Multiple blockchains

– Supported tokens: Over 30 tokens

– Highest APY: Up to 14% for some tokens

– Unique features: Earn weekly rewards, no lock-up period

CoinLoan is a crypto lending platform that also offers a staking platform. CoinLoan currently offers an APY of up to 14% for some tokens. CoinLoan also pays out rewards weekly, which can help you earn more interest.

These are just a few of the many high APY crypto staking platforms available in 2023. It is important to do your own research and choose a platform that is right for you. When choosing a staking platform, consider factors such as the APY offered, the supported tokens, the fees, and the security of the platform.

Understanding Crypto Staking and APY

Crypto staking is a process of locking up cryptocurrencies to support the operations of a blockchain network and earn rewards in return. It is a way to participate in the consensus mechanism of a Proof-of-Stake (PoS) blockchain network and help to secure the network and validate transactions.

In a PoS network, validators are chosen to verify transactions and add new blocks to the blockchain based on the amount of cryptocurrency they have staked. Stakers are rewarded with new coins or tokens for their participation in the network.

How does crypto staking work?

To stake your cryptocurrency, you will need to deposit it into a staking wallet. The staking wallet will then delegate your coins to a validator, who will use them to verify transactions and add new blocks to the blockchain. In return, you will receive rewards, which are typically paid out in the same cryptocurrency that you staked.

The amount of rewards you earn will depend on a number of factors, including the amount of cryptocurrency you stake, the length of time you stake it, and the performance of the blockchain network.

What is APY (Annual Percentage Yield)?

APY, or Annual Percentage Yield, is a measure of the return on investment (ROI) that an investor can expect to earn from staking. APY is calculated by taking the total rewards earned over a period of time and dividing it by the initial investment.

For example, if you stake 100 ETH on a platform that offers an APY of 4.8%, you will earn 4.8 ETH per year. This means that your investment will have grown by 4.8% over the course of one year.

The benefits of crypto staking

There are a number of benefits to crypto staking, including:

– Earning rewards: Staking can be a great way to earn passive income from your cryptocurrency holdings. The amount of rewards you earn will depend on a number of factors, but you can typically expect to earn a higher return than you would from simply holding your cryptocurrency in a wallet.

– Contributing to network security: By staking your cryptocurrency, you are helping to secure the blockchain network and make it more decentralized. This can help to improve the overall security and scalability of the crypto economy.

– Participating in the consensus mechanism: Staking allows you to participate in the consensus mechanism of a PoS blockchain network. This means that you have a say in how the network is run and that you can help to ensure that it remains secure and efficient.

– Access to new features: Some staking platforms offer exclusive features to stakers, such as early access to new tokens or airdrops.

Factors Influencing Staking APY

The APY offered by staking platforms can vary depending on a number of factors, including:

Token type: The type of cryptocurrency you stake will have a big impact on the APY you earn. Some tokens, such as Ethereum (ETH) and Cardano (ADA), offer higher APY than others. This is because they are more popular and have a larger network of validators.

Blockchain network: The blockchain network that the cryptocurrency is on will also affect the APY you earn. Some blockchain networks, such as Solana (SOL) and Tezos (XTZ), offer higher APY than others. This is because they have a faster block time and lower transaction fees, which makes them more attractive for stakers.

Market conditions: The market conditions can also affect the APY you earn. When the price of a cryptocurrency is rising, the demand for staking rewards tends to increase, which can lead to higher APY.

Staking requirements: The staking requirements of a platform can also affect the APY you earn. Some platforms have minimum staking amounts or lock-up periods, which can reduce the APY you earn.

Staking platform: The staking platform you choose will also affect the APY you earn. Some platforms offer higher APY than others, but they may also have higher fees or less security. It is important to choose a reputable and secure staking platform to ensure that you get the best possible APY.

The importance of choosing a reputable and secure staking platform

It is important to choose a reputable and secure staking platform when staking your cryptocurrency. A reputable platform will have a good track record and a solid security infrastructure. A secure platform will protect your cryptocurrency from theft and loss.

Here are some factors to consider when choosing a staking platform:

– Reputation: Do some research to see if the platform has a good reputation. You can read reviews from other users or check out the platform’s social media pages.

– Security: Make sure the platform has a good security infrastructure. This includes things like cold storage, two-factor authentication, and regular security audits.

– Fees: Check the platform’s fees to make sure they are reasonable. Some platforms charge high fees, which can eat into your staking rewards.

– Liquidity: Make sure the platform offers liquidity for the cryptocurrency you want to stake. This means that you should be able to easily sell your staked cryptocurrency if you need to.

By choosing a reputable and secure staking platform, you can minimize your risk and maximize your chances of earning a high APY.

Tips for Successful Crypto Staking

Here are some tips for investors looking to engage in crypto staking:

Do your research: Before you stake any cryptocurrency, it is important to do your research and choose a staking platform that is right for you. Consider factors such as the APY offered, the supported tokens, the fees, and the security of the platform.

Diversify your portfolio: Don’t put all your eggs in one basket. When choosing cryptocurrencies to stake, it is important to diversify your portfolio and stake a variety of tokens. This will help to reduce your risk if the price of one token falls.

Manage your risk: Staking is a relatively low-risk investment, but there is always some risk involved. It is important to manage your risk by only staking an amount of cryptocurrency that you can afford to lose.

Stay updated: It is important to stay updated on platform changes and market trends. This will help you make informed decisions about when to stake your cryptocurrency and which tokens to stake.

Here are some additional tips for successful crypto staking:

– Choose a reputable and secure staking platform. As mentioned earlier, it is important to choose a staking platform that is reputable and secure. This will help to protect your cryptocurrency from theft and loss.

– Read the terms and conditions carefully. Before you stake any cryptocurrency, be sure to read the terms and conditions of the staking platform carefully. This will help you understand the risks involved and what you are entitled to.

– Be patient. Staking is a long-term investment. It may take some time to see a significant return on your investment.

– Don’t panic sell. The cryptocurrency market is volatile, and the price of your staked cryptocurrency may go down at times. Don’t panic sell if this happens. Just be patient and wait for the price to recover.

By following these tips, you can increase your chances of successful crypto staking.

Conclusion

In this article, we have discussed the basics of crypto staking, including what it is, how it works, and the potential benefits of engaging in it. We have also explored the top 7 highest APY crypto staking platforms in 2023.

Here are the key points we have discussed:

- Crypto staking is a process of locking up cryptocurrency to support the operations of a blockchain network and earn rewards in return.

- Staking can be a great way to earn passive income from your cryptocurrency holdings.

- The APY offered by staking platforms can vary depending on a number of factors, including the token type, blockchain network, and market conditions.

- It is important to choose a reputable and secure staking platform when staking your cryptocurrency.

Here are some of the top 7 highest APY crypto staking platforms in 2023:

- Lido

- Binance Staking

- Kraken Staking

- Crypto.com

- Celsius Network

- Nexo

- CoinLoan

By following the tips and information we have provided in this article, you can make informed decisions about whether or not to engage in crypto staking and which platform is right for you.

Here are some additional things to keep in mind when considering crypto staking:

- The cryptocurrency market is volatile, and the price of your staked cryptocurrency may go down at times.

- There are risks associated with crypto staking, such as the risk of losing your cryptocurrency if the staking platform is hacked.

- It is important to do your own research and understand the risks involved before you stake any cryptocurrency.

If you are considering crypto staking, I encourage you to explore the platforms we have mentioned in this article and make an informed decision.

he End Words

At Adaas Capital, we hope that by reading this article you will be fully immersed in the highest APY crypto staking platforms! You can help us improve by sharing this post which is published in Adaas Investment Magazine and help optimize it by submitting your comments.

FAQ

Which crypto platform is the best in staking?

The best crypto platform for staking depends on your individual needs and preferences. However, some of the most popular and reputable staking platforms include:

Binance Staking: Binance is a leading cryptocurrency exchange that offers staking services for a variety of tokens. It offers high APYs and flexible staking terms.

Crypto.com: Crypto.com is another popular cryptocurrency exchange that offers staking services. It offers high APYs and a variety of features, such as earn CRO rewards.

Lido: Lido is a liquid staking platform that allows you to stake your ETH without having to lock it up. It offers high APYs and no lock-up period.

Kraken Staking: Kraken is a secure and reliable cryptocurrency exchange that offers staking services for a variety of tokens. It offers high APYs and flexible staking terms.

Celsius Network: Celsius Network is a crypto lending platform that also offers staking services. It offers high APYs and weekly rewards.

When choosing a staking platform, it is important to consider factors such as the APY offered, the supported tokens, the fees, and the security of the platform. It is also important to do your own research before staking any cryptocurrency.

What is APY in crypto staking?

APY stands for Annual Percentage Yield. It is a measure of the return on investment (ROI) that you can expect to earn from staking cryptocurrency. APY is calculated by taking the total rewards you earn over a period of time and dividing it by the initial investment.

What is crypto staking?

When you stake your cryptocurrency, you are essentially lending it to the network to help it function. In return, you are rewarded with new cryptocurrency. The amount of rewards you earn depends on the amount of cryptocurrency you stake and the length of time you stake it for.

What are the best wallets for crypto staking?

The best wallets for crypto staking include platforms like Coinbase, Binance, Kraken, and Trust Wallet, offering secure staking options for various cryptocurrencies.

This is a topic close to my heart cheers, where are your contact details though?