How to Calculate the GBTC Premium?

A Comprehensive Guide to Understanding Bitcoin Investment Trust Premium

By reading the article “How to Calculate the GBTC Premium” published in Adaas Investment Magazine, you will get acquainted with the GBTC financial instrument and the way to calculate its premium in general. This level of familiarity can be enough when you need educational information about this topic.

These podcasts are published for you!

On September 25, 2013, Grayscale created a financial instrument called Grayscale Bitcoin Trust, abbreviated as GBTC, to create a way to invest in the Bitcoin cryptocurrency market through the stock market.

In the following, we have introduced the GBTC Premium financial instrument, its usage, and how to calculate its premium, so that you have complete information about this very important financial instrument and when making your decisions, you can choose the best option according to other indicators related to your terms.

Table of Contents

What is GBTC Premium?

As we explained to you at the beginning, to create a legal way to invest or trade in the Bitcoin cryptocurrency market through the stock market, the GBTC financial instrument was developed by Grayscale.

Another feature of Grayscale GBTC is the Premium. The term “Premium” added to the name of this Bitcoin trust refers to the difference in the value of the assets held by the trust against the market price of those holdings.

When the market price is higher than the net asset value, the difference is called “Premium”. This rate is not determined by any organization, but the ratio of supply and demand in the trading market causes this difference.

To get additional and detailed information about the GBTC financial instrument, you can visit the product page on the official website of the Grayscale company to get important information such as tax laws, market price, and the amount of bitcoins that can be purchased per share, and so on. Thus you can consider them when making your decisions.

The way to calculate GBTC Premium

One of the questions for many users is how to calculate the GBTC Premium. In the previous section, we mentioned that the premium value is a function of supply and demand and is not determined by the organization.

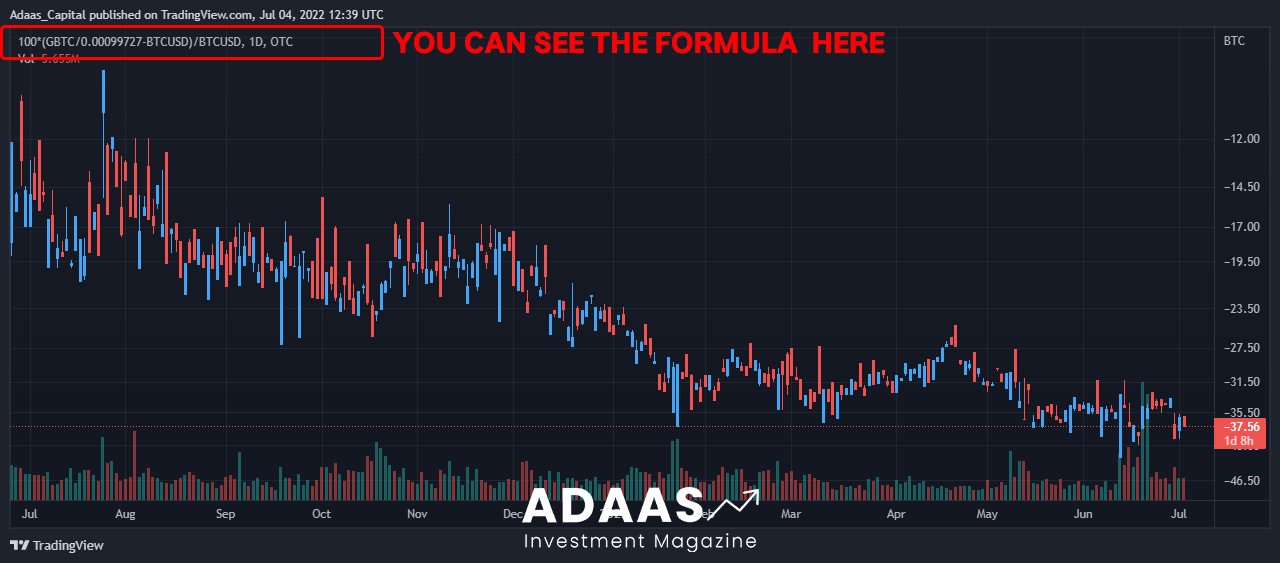

The following formula can be used to calculate GBTC Premium:

100*(GBTC/0.00099727-BTCUSD)/BTCUSD

– The value 0.00099727 represents the number of bitcoins available per share of GBTC.

– Value the amount of GBTC with its current value.

– Also, put the amount of BTCUSD with the current price of Bitcoin cryptocurrency against the US dollar.

To view the chart behavior of this index, you can enter the Tradingview website like the image below, and view and analyze the chart.

Please note that to receive updated information, you must refer to the original and live versions on the reference site.

GBTC Premium and financial markets trading

One of the important usages of GBTC is to enable arbitrage transactions for traders of this instrument. In this way, users can receive Bitcoin loans and exchange them for GBTC shares, and after the waiting period ends, trade GBTC shares in the market with its premium would be available to sell. Finally, with the profit of this transaction, they can buy bitcoins to pay back the amount they borrowed. In this model, due to the outcome of the premium, traders can earn a profit from arbitrage.

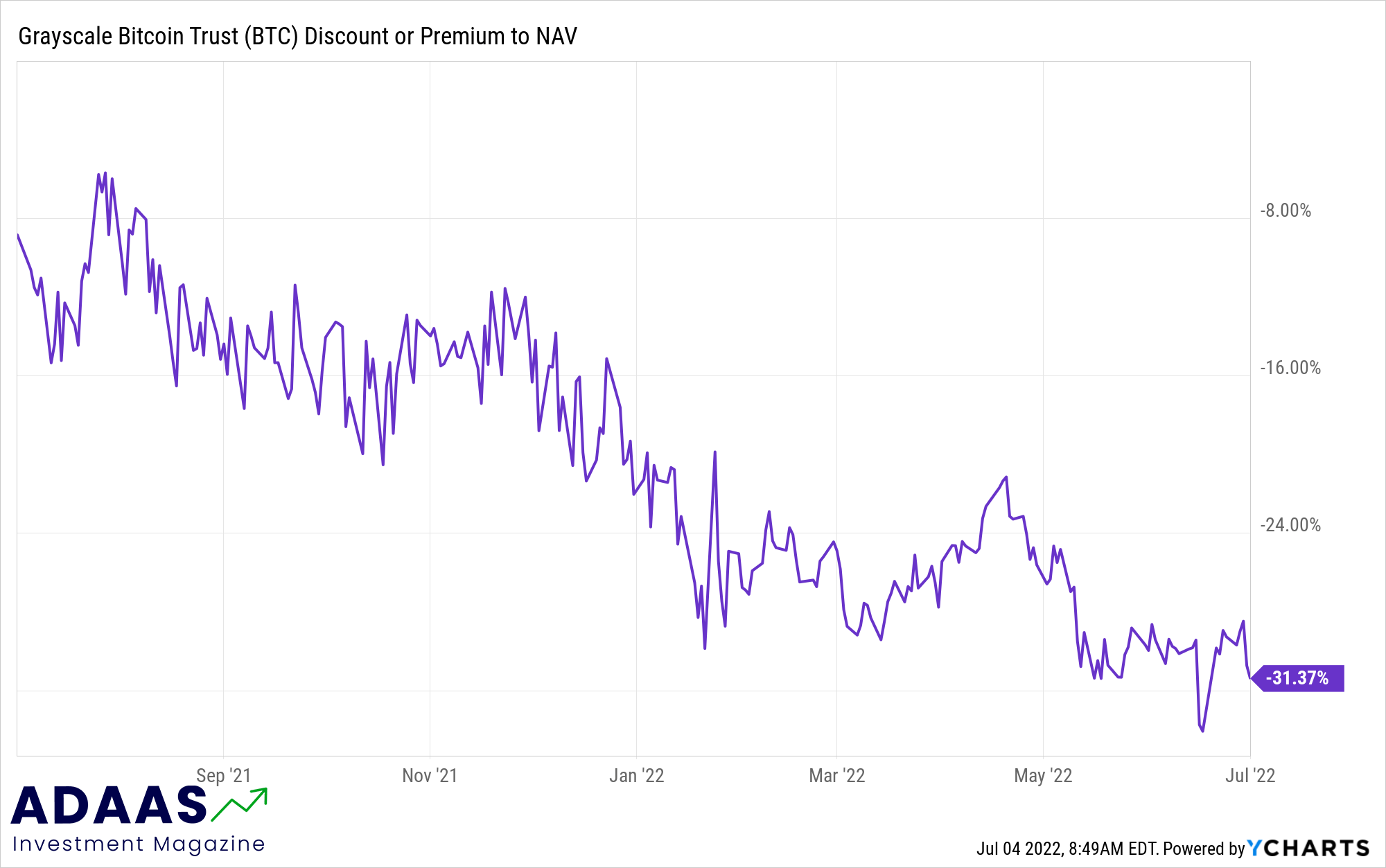

The chart of the ratio of Premium and NAV indexes has somehow become one of the factors of Bitcoin market analysis. In the past few months, when this index has been declining, it indicates the withdrawal of Bitcoin from this Bitcoin trust, and as a result, the price of Bitcoin cryptocurrency has decreased in the spot markets.

Please note that to receive updated information, you must refer to the original and live versions on the reference site.

What are the usages of GBTC?

One of the challenges of entering the cryptocurrency market is the lack of correct and reliable legislation for this market. This issue is very important for big financial market investors or users who want to avoid any tax risk.

To solve this problem and create a way for capital to enter the Bitcoin or other cryptocurrencies market through the stock market, the financial instrument GBTC has been developed. With this instrument, users can trade the value of the Bitcoin cryptocurrency through GBTC shares while following the existing rules for the stock market.

As of July 4, 2022, the value of assets under management in this product at Grayscale Company is more than 12 billion dollars. This shows the demand for financial instruments such as GBTC. After this success, Grayscale has developed other financial tools for other major cryptocurrencies such as Ethereum or Litecoin.

What are the GBTC competitors?

In the financial markets, another product is offered under the name of ETF for traders and investors. As in the article “What is a Bitcoin ETF?” We have explained to you, ETFs are tradable investment funds.

ETF funds are a type of investment fund that consists of various classes and assets, and these funds are traded in global markets like stocks. ETFs and mutual funds are created to help non-professionals in the capital market. By buying one or more units of each ETF, people place their capital under the management of capital market professionals to reduce the risk in investment.

In this way, Bitcoin ETFs have become one of the biggest competitors of this product of Grayscale Company due to offering competitive features such as lower management fees than GBTC and are the choice for traders or investors interested in the Bitcoin cryptocurrency market more than before.

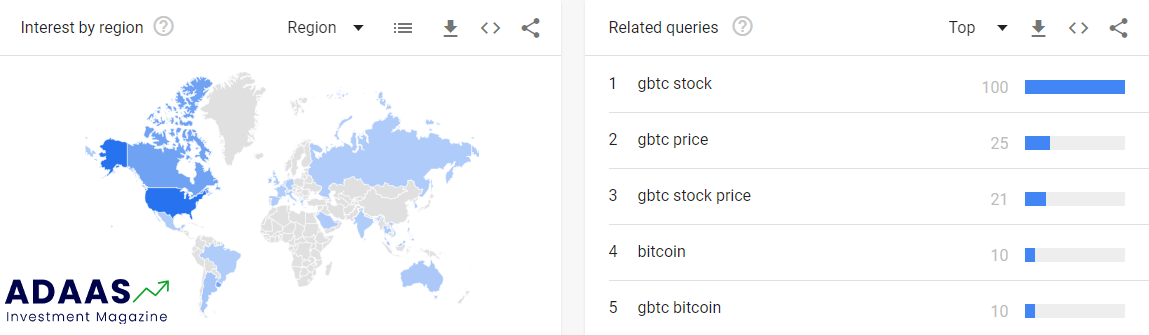

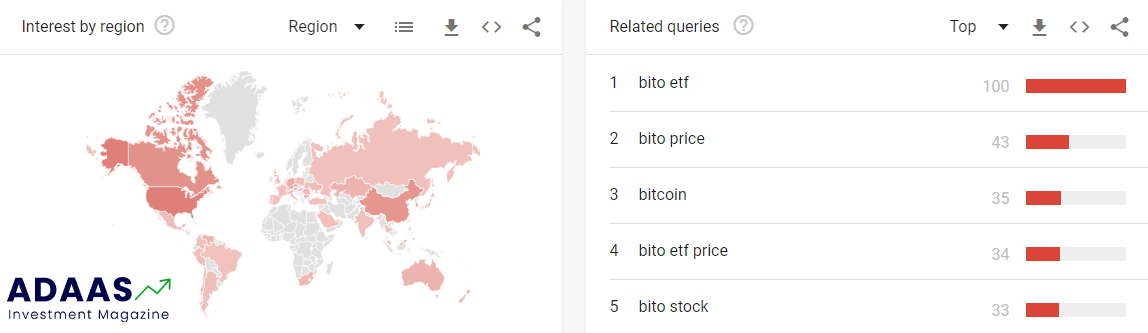

Below are some diagrams related to BITO and GBTC and user searches on Google, which show the close competition between these two financial instruments.

Note that BITO is one of the most popular ETFs to invest in the cryptocurrency market compared to GBTC. If you want to view all diagrams related to the users’ search comparison between GBTC and BITO on google, you can visit the link below which will bring you the Google trends stats.

View All >

A Brief Introduction to Grayscale!

In 2013, the Digital Currency Group company, which is active in the cryptocurrency market investment industry and is known as DCG, opened an investment fund as its sub-series called Gary Scale by Barry Silbert.

The remarkable success of this investment fund was accompanied by the growth of the price of the Bitcoin and as a result the increase in the value of the entire cryptocurrency market. This investment fund was able to increase the value of assets under management to more than 2 billion dollars by 2018, and at the end of 2018, it was able to provide the financial support needed for the development of the Horizen project.

In 2020, the Gary Scale investment fund became the headline of the news and by increasing its Bitcoin trust balance by 160% in less than 6 months, it was able to gain the trust of many investors and traders in its products such as GBTC financial instruments.

This investment fund and its products provide conditions for those interested in investing in the cryptocurrency market, so they can buy an equivalent value without directly buying and holding these assets, and finally, it is possible to trade them in the stock market. To put it simply, the facilitation of Bitcoin and other cryptocurrencies trades is the main task of the Grayscale investment fund and its products such as GBTC Premium.

The End Words

At Adaas Capital, we hope that by reading this article you will be fully immersed in how to Calculate the GBTC Premium. You can help us improve by sharing this article which is published in Adaas Investment Magazine and help optimize it by submitting your comments.

FAQ

What is the GBTC Premium?

The term “Premium” added to the name of this Bitcoin trust refers to the difference in the value of the assets held by the trust against the market price of those holdings.

How the premium of GBTC is calculated?

You can visit the GBTC Premium charts or use the below formula:

100*(GBTC/0.00099727-BTCUSD)/BTCUSD