What is Yield Farming? A Comprehensive Guide to Maximize Profits!

One important application of decentralized financial systems (DeFi) is Yield Farming. Yield Farming is a strategy for making money from cryptocurrencies. In the Yield Farming strategy, individuals have been rewarded a fee for lending their cryptocurrencies through smart contracts and platforms that offer Yield Farming.

Join Adaas Investment Magazine to answer the question “What is Yield Farming?”

The Podcast Is Published For YOU!

Table of Contents

What is Yield Farming in the DeFi?

To fully understand the concept of Yield Farming, we first need to study concepts such as liquidity pools, liquidity suppliers, smart contracts, and decentralized finance (DeFi) very quickly and easily.

Decentralized Finance (DeFi)

A decentralized financial system was created with the goal of eliminating intermediaries such as banks and legislatures in finance. How to implement this process is a bit specialized, but in simple terms, blockchain technology and smart contracts based on this technology allow the implementation of a decentralized financial system and its easy use. In this financial system, you do not have age, sex, religion, geography, etc. restrictions to receive a loan, and with only one system connected to the Internet, you can do all your finances with the lowest fees.

Smart Contracts

Simply put, smart contracts are pieces of programmed code based on blockchain technology. The main purpose of innovating smart contracts is trust between users by computer.

Liquidity Pool

Liquidity pool is an innovation created by the advent of DeFi and Decentralized Exchange (DEX). Decentralized exchanges provide all assets that can be traded through liquidity pools. Liquidity pools are a smart contract.

Liquidity Provider

People who put their assets in liquidity pools are defined as liquidity Providers. These people receive a fee by locking their assets in these smart contracts.

Yield Farming Definition

Obviously, you understand the process of making a profit in liquidity pools. People receive rewards by locking their cryptocurrencies in these contracts, which are also in the form of cryptocurrencies.

This process of making a profit is called Yield Farming. This innovation is currently underway in the Ethereum Network and its decentralized finance protocols, and individuals can select tokens defined on the Ethereum platform in Yield Farming projects and lock in Decentralized Finance liquidity pools to make a profit.

What is the difference between Yield Farming and Stacking?

As you may have noticed by now, Yield Farming is making a profit by providing liquidity in the liquidity pools of decentralized exchanges. On the other side of the stacking process is the locking of digital assets in “Proof of Stake | PoS” networks to verify transactions. In both Yield Farming and Stacking processes, people receive rewards in the form of cryptocurrencies by locking their cryptocurrencies, but the difference is in the technical aspects of these processes.

Due to the beginner to intermediate level of this article, we have avoided explaining these technical differences professionally!

DeFi and Yield Farming health index with “Total Value Locked”

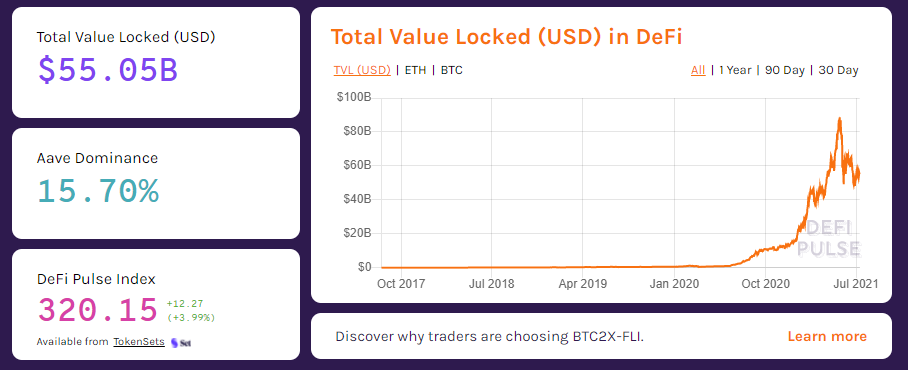

The “Total Value Locked | TVL” is one of the best ways to check the soundness of decentralized finances and Yield Farming projects. The TVL index represents the total value of cryptocurrencies locked in DeFi lending platforms, and in simpler terms, this index represents the sum of the total liquidity in liquidity pools. Many people use this index to analyze the health of Yield Farming projects.

In the following, we have shown you the DEFI PULSE site, which shows the total value locked index in decentralized finance (DeFi) in dollars. Obviously, the growth of this index indicates the confidence of investors and the growth of this innovation.

Benefits and risks in Yield Farming

Main Features

The biggest advantage of Yield Farming innovation is the amount of profit from this investment. The relationship between fast participation in new Yield Farming projects and the amount of profit is a linear and direct relationship; Of course, the timing of the sale of reward codes also has a significant effect on the profitability of Yield Farming.

Existing Risk

On the other hand, just as Yield Farming provides significant benefits to investors, it poses great risks to investors. The emergence of decentralized financial technology is causing projects to be attacked by hackers. Also, technical problems in developing smart contracts put investors in a position to accept large investment risks.

An important point in investing with Yield Farming

Before you start locking your cryptocurrencies in Yield Farming platforms, you should know that this process of making a profit is one of the most complex profit-making strategies through cryptocurrencies, and your slightest mistake will cause you to lose capital and irreparable losses.

Introducing Yield Farming projects and platforms

There are several platforms for investing in Yield Farming, we have published the best investment platforms through Yield Farming in Adaas Investment Magazine. Note that this list will be updated with the emergence of powerful new platforms that will gain market dominance.

Compound Finance

Compound Finance is an algorithm-based money platform. People with Atrium wallets can participate in cash pools and make a profit. Reward rates for participation are determined algorithmically based on supply and demand.

Maker DAO

“Maker DAO” is a decentralized credit platform. This platform supports stable-coin DAI. In this platform, people can lock in assets such as BAT, USDC, ETH, and WBTC and make a profit.

Synthetix

” Synthetix ” is a synthetic asset platform. People in this platform can lock SNX and ETH cryptocurrencies and earn money.

Aave

“Aave” is a decentralized lending platform. Yield Farming’s reward rate in this platform is also calculated algorithmically. Yield Farmers are rewarded with an “Aave” token.

UniSwap

UniSwap is a decentralized exchange. Individuals can make a profit by locking their assets in the liquidity pools of this exchange.

Numerous other platforms have been developed for Yield Farming, including Curve Finance, Balancer, Yearn. finance, which offers many features for Yield Farmers. The final decision to choose the Yield Farming platform is made by the individuals themselves with the knowledge of the investors themselves.

The End words

At Adaas Capital, we hope that by reading this article you will find the answer to the question “What is Yield Farming?” Comprehensively. You can help us improve by sharing the article “What is Yield Farming in DeFi?” Published in Adaas Investment Magazine, and help optimize this article by submitting your comments.

References

FAQ

What is Yield Farming?

In the Yield Farming profit strategy, individuals are charged a fee for lending their digital currencies through smart contracts and platforms that offer Yield Farming.

What are the most important Yield Farming projects and platforms?

– Compound Finance

– Maker DAO

– Synthetix

– Aave

– UniSwap

– Yearn.finance

Best view i have ever seen !

I would be our pleasure to hear that from you!