What Companies Are In The Finance Field?

Exploring the Finance Industry: Top Companies, Emerging Trends, and Challenges

By reading the article “What Companies Are In The Finance Field?” published in Adaas Investment Magazine, you will be fully familiar with the finance industry’s top companies alongside with industry’s trends and challenges! This level of familiarity can be enough when you need educational information about this topic.

The podcast is published for you!

The finance industry is a critical component of our global economy, encompassing a vast range of companies and services. At its core, the finance industry provides the means for individuals and businesses to manage their finances, invest their money, and protect themselves against financial risk. It is responsible for facilitating the flow of capital between individuals, businesses, and governments, enabling economic growth and development.

The finance industry is composed of many different types of companies that offer a diverse range of products and services. Commercial banks provide loans, credit cards, and savings accounts to individuals and businesses, while investment banks facilitate the underwriting of securities, mergers and acquisitions, and other corporate finance transactions. Insurance companies offer various types of insurance products to help individuals and businesses manage risk, while asset management firms manage portfolios of stocks, bonds, and other financial assets.

The finance industry has a significant impact on our daily lives, from the interest rates we pay on our loans to the returns we earn on our investments. It plays a vital role in enabling businesses to grow, expand, and create jobs, and in helping individuals achieve their financial goals. The finance industry also has a significant impact on the global economy, with financial institutions playing a critical role in facilitating international trade and investment.

In this article, we’ll explore the top finance companies based on their revenue, different types of companies in the finance field, emerging finance companies, industry trends, and challenges. By the end of this article, you’ll have a better understanding of the importance and scope of the finance industry and the challenges and opportunities facing finance companies today.

Table of Contents

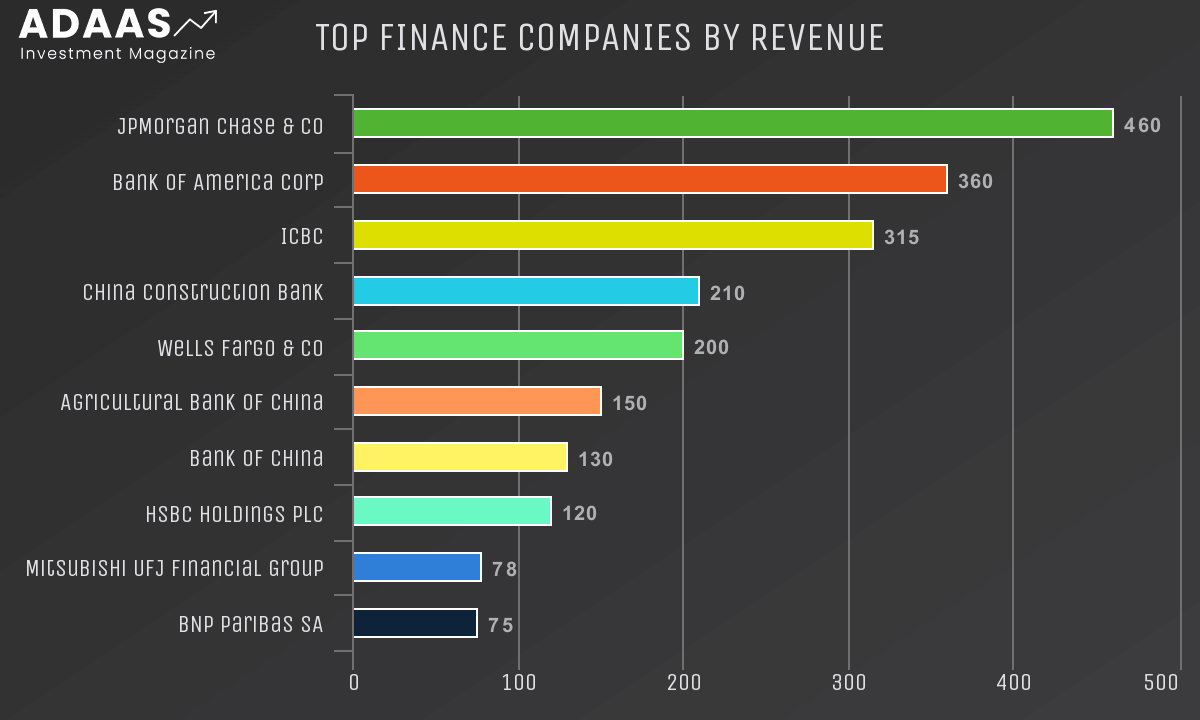

Top Finance Companies by Revenue

Revenue is one of the most important metrics for evaluating the success of finance companies. The following are the top ten finance companies in the world, based on their revenue:

JPMorgan Chase & Co. – With a market capitalization of over $460 billion, JPMorgan Chase & Co. is a global leader in investment banking and asset management. It has over $3.7 trillion in assets under management and offers a wide range of services, including commercial banking, retail banking, and wealth management.

Bank of America Corp. – With a market capitalization of over $360 billion, Bank of America Corp. is a global leader in commercial and investment banking. It offers a range of services, including commercial banking, retail banking, and wealth management.

Industrial and Commercial Bank of China (ICBC) – With a market capitalization of over $315 billion, ICBC is the largest finance company in the world by revenue. It is a Chinese multinational banking company that offers a range of services, including personal banking, corporate banking, investment banking, and asset management. ICBC has a significant presence in China and other countries, such as the UK, Canada, and the US.

China Construction Bank – With a market capitalization of over $210 billion, China Construction Bank is the second-largest finance company in the world. It is also a Chinese multinational banking company that offers a range of services, including personal banking, corporate banking, investment banking, and asset management. It has a significant presence in China and other countries, such as Hong Kong, Singapore, and Australia.

Wells Fargo & Co. – With a market capitalization of over $200 billion, Wells Fargo & Co. is an American multinational banking and financial services company. It offers a range of services, including commercial banking, investment banking, asset management, and insurance. Wells Fargo has a significant presence in the US and other countries, such as the UK and Canada.

Agricultural Bank of China – With a market capitalization of over $150 billion, the Agricultural Bank of China is the third-largest finance company in the world. It is also a Chinese multinational banking company that primarily serves rural areas in China, providing a range of services such as personal banking, corporate banking, and investment banking.

Bank of China – With a market capitalization of over $130 billion, Bank of China is another Chinese multinational banking company that offers a range of services such as personal banking, corporate banking, and investment banking. It has a significant presence in China and other countries such as the UK, Canada, and the US.

HSBC Holdings PLC – With a market capitalization of over $120 billion, HSBC Holdings PLC is a British multinational banking and financial services company. It offers a range of services, including commercial banking, investment banking, and asset management. HSBC has a significant presence in Asia, Europe, and the Americas.

Mitsubishi UFJ Financial Group – With a market capitalization of over $78 billion, Mitsubishi UFJ Financial Group is a Japanese multinational banking and financial services company. It offers a range of services, including commercial banking, investment banking, asset management, and insurance.

BNP Paribas SA – With a market capitalization of over $75 billion, BNP Paribas SA is a French multinational banking and financial services company. It offers a range of services, including commercial banking, investment banking, asset management, and insurance. BNP Paribas has a significant presence in Europe, the Americas, and Asia.

These top finance companies have a significant impact on the global economy and offer a wide range of services to individuals and businesses.

Types of Companies in the Finance Field

The finance field is vast, and there are many different types of companies operating within it. Some of the most common types of companies in the finance field include:

Banks – Banks are financial institutions that accept deposits and offer a range of financial products and services, including personal and commercial loans, savings and checking accounts, and investment products such as certificates of deposit and mutual funds. Banks are regulated by governmental agencies and are required to maintain certain levels of reserves to ensure they can meet customer demand for withdrawals.

Insurance companies – Insurance companies offer various types of insurance policies, such as life, health, property, and casualty insurance. These policies provide financial protection to individuals and businesses in the event of unforeseen circumstances such as accidents, illness, or natural disasters. Insurance companies generate revenue by collecting premiums from policyholders and investing those funds to generate returns.

Investment banks – Investment banks offer financial services such as underwriting securities, mergers and acquisitions advisory services, and trading securities. They typically work with corporations, governments, and other large organizations to help them raise capital and manage their financial affairs. Investment banks are often involved in high-profile deals and transactions and play a significant role in the global financial markets.

Brokerage firms – Brokerage firms facilitate the buying and selling of securities, such as stocks, bonds, and mutual funds, on behalf of clients. They earn revenue by charging fees or commissions on these transactions. Brokerage firms also provide research and analysis on securities to help clients make informed investment decisions.

Credit unions – Credit unions are non-profit financial institutions that are owned by their members. They offer many of the same products and services as banks, such as checking and savings accounts, loans, and credit cards. However, credit unions typically offer lower fees and better interest rates than traditional banks.

Venture capital firms – Venture capital firms provide funding to start-ups and early-stage companies that have high growth potential. They typically invest in exchange for equity and work closely with the companies they invest in to help them grow and succeed.

Private equity firms – Private equity firms invest in mature companies that are not publicly traded. They typically buy a controlling stake in the company and work to improve its operations and profitability before selling it for a profit.

These are just a few examples of the types of companies operating in the finance field. Each of these companies plays an important role in the global economy and offers unique products and services to individuals and businesses. Understanding the different types of companies in the finance field can help individuals make informed decisions about their finances and investments.

Emerging Finance Companies

In addition to well-established finance companies, there are also emerging finance companies that are disrupting the industry and changing the way people access financial products and services. These companies are often referred to as fintech companies and leverage technology to create innovative solutions for customers.

Peer-to-peer lending platforms – Peer-to-peer lending platforms connect borrowers directly with lenders, cutting out traditional banks and financial institutions. This enables borrowers to access loans at lower rates and allows investors to earn higher returns on their investments.

Digital banks – Digital banks operate entirely online and offer a range of banking products and services, including checking and savings accounts, loans, and credit cards. They often have lower fees and better interest rates than traditional banks and are accessible to anyone with an internet connection.

Robo-advisors – Robo-advisors are automated investment platforms that use algorithms to create and manage investment portfolios for clients. They offer lower fees than traditional investment advisors and can provide personalized investment advice based on a client’s goals and risk tolerance.

Cryptocurrency companies – Cryptocurrency companies enable users to buy, sell, and store digital currencies such as Bitcoin and Ethereum. These companies offer an alternative to traditional financial institutions and have gained popularity in recent years due to their decentralized and secure nature.

Insurtech companies – Insurtech companies leverage technology to provide innovative insurance solutions, such as pay-per-mile auto insurance or on-demand renters insurance. They often have streamlined processes and use data analytics to provide more accurate pricing and risk assessment.

Payment processing companies – Payment processing companies enable businesses to accept electronic payments, such as credit card payments and online payments. They often offer lower fees and faster processing times than traditional payment processors.

These emerging finance companies are changing the financial landscape and offering consumers new and innovative ways to manage their money. While they may not yet have the same brand recognition as traditional finance companies, they are gaining traction and disrupting the industry. As technology continues to advance, we can expect to see even more innovation and disruption in the finance field.

Industry Trends and Challenges

The finance industry is constantly evolving, driven by technological advancements, changing customer preferences, and regulatory changes. Here are some of the most significant trends and challenges facing the industry today:

Digital transformation – The finance industry is undergoing a digital transformation, with more and more companies adopting digital technologies to streamline processes and improve customer experiences. This includes the use of artificial intelligence, big data analytics, and blockchain technology.

Increased competition from fintech companies – As mentioned earlier, fintech companies are disrupting the finance industry and challenging traditional finance companies. Established finance companies need to innovate and adapt to stay competitive and retain customers.

Cybersecurity threats – With the increasing digitization of financial services comes an increased risk of cybersecurity threats. Financial companies need to ensure that they have robust cybersecurity measures in place to protect customer data and prevent breaches.

Regulatory changes – Financial companies are subject to various regulations and compliance requirements, which can be complex and costly to navigate. Changes to regulations, such as the introduction of GDPR in the EU or the recent changes to the Dodd-Frank Act in the United States, can have significant impacts on the industry.

Changing customer expectations – Customers expect personalized and convenient experiences when it comes to financial services. Finance companies need to be able to offer tailored solutions and digital experiences that meet these expectations.

Economic uncertainty – Economic uncertainty, such as the recent COVID-19 pandemic, can have a significant impact on the finance industry. Financial companies need to be able to adapt to changing economic conditions and provide support to customers during times of financial stress.

The finance industry is facing significant challenges and undergoing rapid transformation. Companies that can adapt to these changes and stay ahead of industry trends will be best positioned for success. By embracing new technologies, innovating products and services, and prioritizing cybersecurity and regulatory compliance, finance companies can meet the evolving needs of customers and remain competitive in the industry.

Conclusion

The finance industry is a complex and dynamic field, with a wide range of companies and players offering a diverse set of products and services. From the largest multinational banks to emerging fintech startups, the industry is constantly evolving and facing new challenges and opportunities.

As we have seen, the top finance companies by revenue include major global players such as JPMorgan Chase, Goldman Sachs, and Wells Fargo. However, the industry also includes many different types of companies, from insurance providers to investment firms to payment processors.

Moreover, emerging finance companies, such as peer-to-peer lending platforms, digital banks, and robo-advisors, are changing the way people access financial products and services. They are leveraging technology to offer more personalized and convenient experiences, disrupting traditional finance companies, and challenging established players in the industry.

While the finance industry faces numerous challenges, including increased competition from fintech companies, cybersecurity threats, and changing customer expectations, it also offers many opportunities for innovation and growth. Companies that can adapt to these changes and stay ahead of industry trends will be best positioned for success.

In conclusion, the finance industry plays a critical role in our economy, providing essential products and services to individuals and businesses alike. As the industry continues to evolve, we can expect to see even more innovation and disruption, driven by advances in technology, changing customer preferences, and regulatory changes. By staying ahead of these trends and challenges, finance companies can continue to meet the evolving needs of customers and thrive in this dynamic industry.

The End Words

At Adaas Capital, we hope that by reading this article you will be fully immersed in What Companies Are In The Finance Field! You can help us improve by sharing this post which is published in Adaas Investment Magazine and help optimize it by submitting your comments.

FAQ

What is an example of a finance company?

Goldman Sachs, JPMorgan Chase, Wells Fargo, and BlackRock are examples of finance companies.

Is fintech a part of finance?

Yes, fintech (financial technology) is a part of finance. It refers to the use of technology to improve and automate financial services, including banking, insurance, investment, and payment services.

What are the three main types of finance companies?

The three main types of finance companies are consumer finance companies, commercial finance companies, and captive finance companies.