How To Set a Stop-Loss (Stop-Limit) on Kucoin!

Comprehensive Tutorial on Implementing Stop-Loss Orders on KuCoin: Protecting Your Investments

By reading the article “Set a Stop-Loss on Kucoin” published in Adaas Investment Magazine, you will get acquainted with How To Set a Stop-Loss (Stop-Limit) on the Kucoin exchange. This level of familiarity can be enough when you need educational information about this topic.

These podcasts are published for you!

Traders and investors in financial markets such as the cryptocurrency market always use principles and techniques for the risk management process. In this process, techniques such as stop-loss and take-profit orders are considered automatically so that the trades proceed as planned when the process of trade manual management is not possible.

Exchanges that provide cryptocurrency services such as Kucoin or Binance provide different trading facilities for their users. Among these possibilities is specifying the stop-loss in trades, which we have prepared for you in the following, tutorial of How To Set a Stop-Loss (Stop-Limit) on Kucoin.

Table of Contents

Stop-loss order in Kucoin

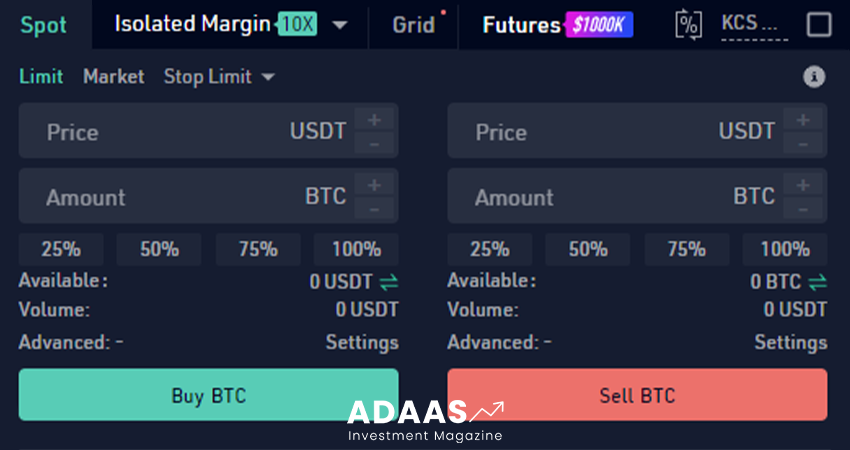

setting up a stop-loss order in the Kucoin exchange has different types in various trades. In the SPOT trading market, a variety of order models are provided for the user to buy or sell an asset, each of which has a different function, and we will examine them further.

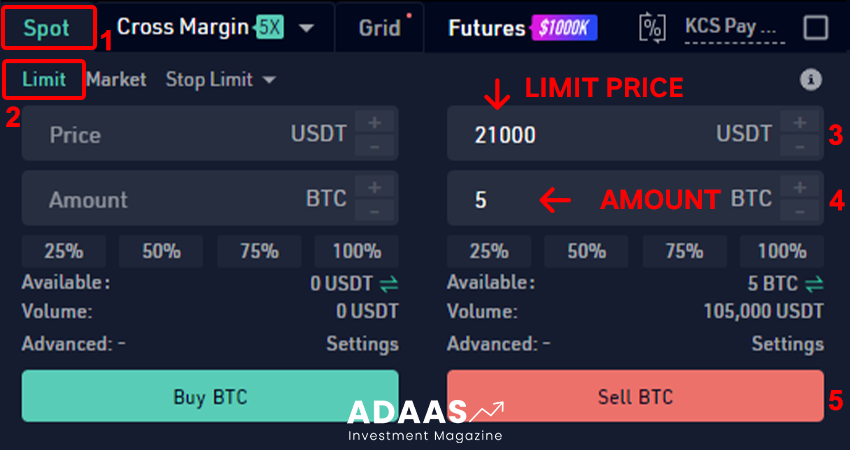

Stop-loss order with Limit type

First, we must choose the type of order from the options provided. Due to the different performance of the orders, the easiest way to order the Stop-loss in Kocoin exchange is to use Limit type trades. In this type of order, we specify at what price, and how much of our inventory to sell.

For example, in the Price field, we specify that when the price of Bitcoin reaches the $21,000 level, our Bitcoins will be sold in the market. In this order, in the Amount field, we enter the amount we intend to sell. As can be seen, options between 25 and 100 percent can be chosen for us. This option indicates how many percent of our total reserve will be sold in this stop-loss order.

Consequently, we have registered an order in the Kucoin market to sell all our inventory in the market when the price of Bitcoin cryptocurrency reaches the area of $21,000, and as a result, a Stop-loss order in the Kucoin exchange has been registered successfully.

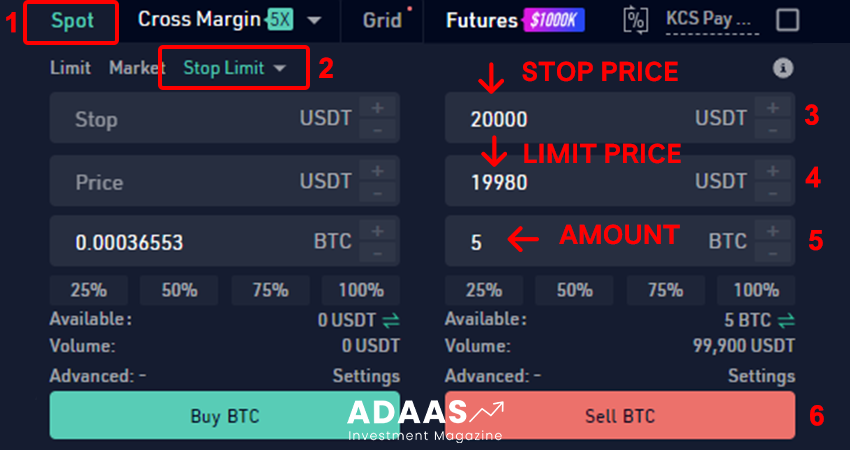

Stop-loss order with the Stop Limit model

Another type of ordering model in Kucoin exchange is provided for traders and investors, which is called Stop Limit. Imagine that there is a very strong support area in the direction of the price movement of an asset, and the possibility of a change in the direction of the price trend in this area is very high. At the same time, you want to place a stop loss order if this support level is broken. In this case, we use the Stop Limit ordering model.

In this type, in addition to the Price and Amount fields, there is a new field named Stop, which we must fill to complete the stop loss order. In this field, we specify at what price the order will be activated. For example, in the Stop field, we enter the price of 20 thousand dollars and in the Price field, we enter the price of 19980 dollars.

In this way, we have recorded a stop loss order with the stop limit type in the Kucoin exchange, which works as follows: when the price reaches the range of 20 thousand dollars, the stop loss order is ready to be registered in the market, and if the price reaches the 19980 area dollars, the specified amount of the asset to be sold in the market.

What is a stop-loss order?

Risk management is one of the important principles in trading and investing in financial markets. This means participating only a certain part of the total capital in the trades that amount of risk is known.

In the principle of risk management, the most important process is to specify the stop loss order for trades. The stop loss is an order that the trader registers according to the trading conditions in the market to select the maximum amount of loss in a trade. This order prevents the destruction of the entire trader’s capital in unexpected market drops.

Stop loss orders are divided into two types: dynamic and static. In this post, the instruction on static stop loss order in the Kucoin exchange has been published for you. Dynamic stop loss order is a type of stop loss orders which, according to the profit or loss conditions of a trade position, the price of the stop loss order is changed dynamically in order to obtain the maximum amount of profit in that trade.

Introducing KuCoin Exchange

KuCoin Exchange was founded in 2017 by Michael Gan and Eric Don. They have chosen their slogan “People’s Exchange” to express the simplicity and publicity of the KuCoin cryptocurrency services platform.

The founders of this exchange have already gained successful experiences in iBoxPAY and AntFinancial. This has helped them put KuCoin Exchange in the top 10 cryptocurrency exchanges and attract more than 6 million users.

The native KuCoin exchange token is called KCS, which was developed under the Ethereum blockchain with the ERC-20 standard.

KuCoin Fees

KuCoin Exchange is also trying to be one of the cheapest platforms providing cryptocurrency services. In the following, we have prepared fees for different processes for you.

Trading fees

If you are a professional trader with high transaction volume and traffic, KuCoin Exchange offers a better fee structure and can also be a better choice.

At KuCoin Exchange for cryptocurrency transactions with each other, a fee of up to 0.1% is provided for users. But you should keep in mind that this fee is not calculated for trading cryptocurrency with Fiat currency.

For example, if you want to trade Ethereum cryptocurrency with Fiat Dollar Currency, a fee of between 3% and 12% will be charged to you.

The End Words

At Adaas Capital, we hope that by reading this article you will be fully immersed in How To Set A Stop-Loss (Stop-Limit) On Kucoin. You can help us improve by sharing this post which is published in Adaas Investment Magazine and help optimize it by submitting your comments.

FAQ

What types of stop loss are available in Kucoin?

You can place your stop loss orders in the three types which are :

1- Limit

2- Stop Limit

3- Stop Market

What is a stop loss order?

The stop loss is an order that the trader registers according to the trading conditions in the market to select the maximum amount of loss in a trade.